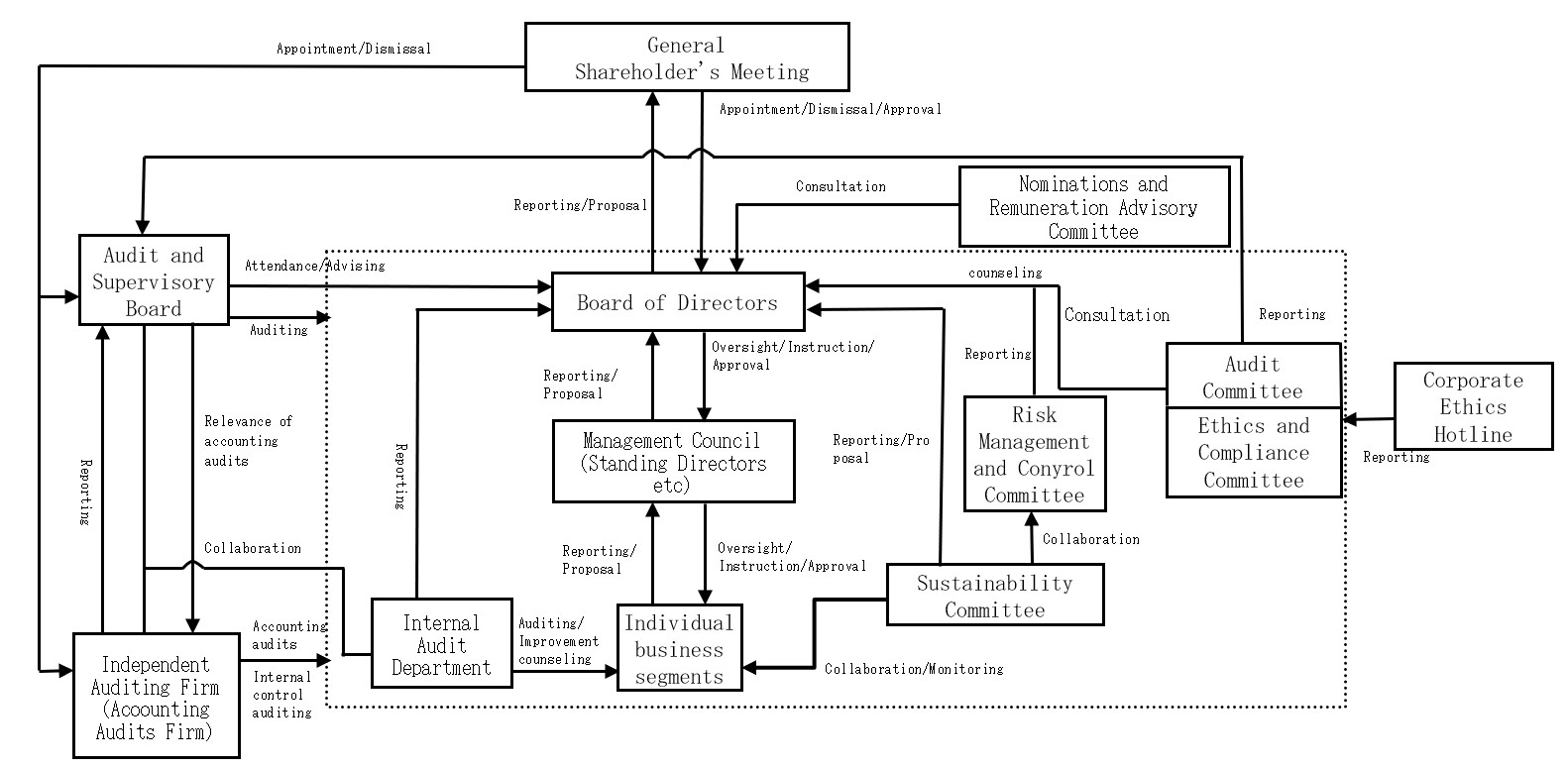

The Senshukai Group recognizes corporate governance as an essential element in fulfilling its social responsibility to various stakeholders including shareholders, customers, employees, business partners, and local communities. In view of the significance of building a highly transparent management system and ensuring that it functions effectively, the Group strives to clarify the oversight responsibilities of its directors, strengthen its compliance system, and make timely, accurate, and full information disclosure toward fortifying corporate governance.

Senshukai finds a "Company with Board of Company Auditors" to function more effectively than a "Company with Committees" from the perspective of corporate governance. Accordingly, it adopts the former system and establishes a Board of Directors, consisting of eight directors including three outside directors, and an Audit & Supervisory Board, consisting of three auditors including two outside auditors.

- Corporate Governance Guideline

- Status to the Corporate Governance Code

- Governance System

- Internal Control System

Corporate Governance Guideline

Article 1Exercise of shareholder rights at general shareholders meetings

- 1.Senshukai develops an environment in which to fully secure shareholder rights and gives adequate consideration to securing the rights of minority shareholders and foreign shareholders.

- 2.Senshukai believes that accurate information should be provided to shareholders as necessary in order to facilitate appropriate decision-making at general shareholders meetings. Accordingly, it provides accurate information through convening notices for general shareholders meetings, the Senshukai website, and the Timely Disclosure network (TDnet) operated by the Tokyo Stock Exchange.

- 3.Senshukai sends convening notices two weeks before the date of the general shareholders meeting to give shareholders sufficient time to consider the agenda. Information included in the convening notice is translated into English and, prior to sending the convening notice, disclosed through the Senshukai website and TDnet.

- 4.Senshukai uses the Electronic Voting Platform to allow the exercise of voting rights by institutional investors and foreign investors.

- 5.Senshukai determines the date of general shareholders meetings and associated dates with consideration to facilitating sufficient constructive dialogue with shareholders and ensuring the accuracy of information necessary for such dialogue.

Article 2Cross-shareholdings

- 1.Senshukai holds shares of other listed companies as cross-shareholdings where it deems meaningful, comprehensively taking into consideration relevance to the business of the issuing company, inter-company collaboration and inter-business synergy, business strategy, and business alliance. Cross-shareholdings are reported each year at board of directors meetings, where a decision is made on continuing the cross-shareholdings, taking into account factors such as transaction history and current price. Shares deemed to have little meaning are sold off.

- 2.Senshukai will make individual decisions regarding the exercise of voting rights for strategically held stocks after comprehensively considering the medium- to long-term improvement of the corporate value of the issuing company and the possibility of adversely affecting the Group. With respect to the surplus disposal bill, the dividend payout ratio will be used. For other bills, the judgment criteria will be whether it contributes to the enhancement of the corporate value of the Company.

Article 3Related party transactions

- 1.When engaging in transactions with the management and major shareholders, Senshukai requires approval and reporting at board of directors meetings, where the matter is treated as an approved item based on the Board of Directors Regulations. As a rule, the relevant board meetings require the attendance of independent outside directors. Any views presented are recorded in the board meeting minutes.

- 2.As a measure to build a system for controlling conflicts of interest, a questionnaire survey is conducted each year targeting all officers of Senshukai (including major subsidiaries) to verify whether or not related party transactions have taken place.

Article 4Appropriate cooperation with stakeholders Senshukai endeavors to appropriately cooperate with stakeholders, including employees. The board of directors, directors exercise leadership to this end.

Article 5Management philosophy, CSR, and sustainability

- 1.Senshukai builds its business operations on the foundation of the corporate philosophy "Contributing to society is the purpose of the company's existence. Only by staying committed to this truth can the company prosper" and the corporate vision "Women's Smiles Company" with the aim of creating value for all stakeholders and enhancing the corporate value of the Senshukai Group over the medium to long term.

- 2.Senshukai establishes three corporate social responsibility themes to which it endeavors consistently: 「With women」, 「Environment」, 「Compliance」.

Article 6Code of conduct

- 1.Senshukai has in place a creed expressing its management policy and, based on this, a set of house morals (Senshukai-jin kokoroe) to be followed daily and forming the base of business activities. To promote understanding of the contents and enhance internal recognition as well as to strengthen the Senshukai compliance system, a collection of case studies (Senshukai kodo case book) lists rules to be observed by officers and employees as members of society, members of a corporation, and members of Senshukai.

- 2.Senshukai distributes the Senshukai-jin kokoroe and Senshukai kodo case book to its officers and employees. Officers use the titles to guide their actions on a daily basis.

Article 7Whistle-blowing

- 1.Senshukai establishes a whistle-blowing system, the Senshukai Group Corporate Ethics Hotline, for promptly dealing with latent risks such as violation of laws and internal regulations.

- 2.When a compliance issue arises, the case is handed on to internal and external contact points in accordance with the Whistle-blowing Regulations and referred to the Audit Committee in the case of an officer, or the Ethics and Compliance Committee in the case of an employee, for deliberation.

- 3.The Whistle-blowing Regulations prescribes a framework for protecting the whistle-blower.

Article 8Ensuring diversity through participation of global human resources and women

- 1.Senshukai believes that In order to provide products and services that make customers smile and to wrap their lives with smiles, we will first strive to create an environment that values employee well-being so that employees can work with smiles.

- 2.We foster an inclusive corporate culture in which everyone recognizes differences regardless of age, gender, disability, etc., and each employee can demonstrate their abilities and continue working with enthusiasm.

- 3.Based on the Diversity Promotion Policy and the Women's Advancement Promotion Policy, we will improve the work environment so that diverse human resources can play an active role in all areas.

The "Balance Support Manual", which explains employees in an easy-to-understand manner from pregnancy to childbirth and balancing childcare, is posted on the intranet for dads, moms, bosses, and colleagues.

In 2018, we opened a company-led nursery school "Egao no Tane".

Article 9Enhancement of imformation disclosure

- 1.Senshukai makes active efforts to disclose financial and non-financial information beyond that required by law. It strives to ensure that non-financial information is accurate, clear, and useful.

- 2.Senshukai discloses in a fair, timely, and accurate manner important corporate information that affects investment decisions and, based on the Timely Disclosure Regulations, other corporate information deemed to be useful in understanding Senshukai.

- 3.Bearing in mind the number of foreign investors, Senshukai discloses English translations of documents such as financial results and convening notices for general shareholders meetings.

Article 10Accounting auditors

- 1.Senshukai takes steps to ensure proper audits by accounting auditors.

- 2.Senshukai follows its Auditor Audit Standards in determining renewal of contracts with accounting auditors. The audit & supervisory board follows the content of audits through reporting from accounting auditors and by attending on-site audits, and with consideration to items such as quality control system, audit plans, audit system, and appropriateness of issues identified through audits, evaluates accounting auditors and makes a decision on reappointment in audit & supervisory board meetings each fiscal year

- 3.Pursuant to the preceding paragraph, the independence and expertise of accounting auditors are verified each fiscal year.

- 4.Senshukai secures sufficient time for audits through advance discussion with accounting auditors and the reception of audit plans including proposed number of days. Following audits, it receives reporting on the number of days devoted to the audit and verifies that the length of time was sufficient.

- 5.Senshukai provides regular opportunities for communication between accounting auditors and the president and division directors.

- 6.Senshukai promotes cooperation between auditors and its internal audit office through briefings of audit plans by accounting auditors, quarterly review sessions, and annual reporting sessions. At the request of accounting auditors, it provides opportunities for discussion with the outside director as deemed appropriate.

- 7.In the event outside accounting auditors request correction of misconduct, inadequacies, or concerns, the president instructs the division directors to lead necessary investigative and corrective procedures, and submit a report of the results. As circumstances require, a third-party investigative committee is assembled to address concerns.

Article 11Roles of the board and directors

The board of directors appropriately fulfills its roles and responsibilities, including the following.

- 1)Setting the broad direction of corporate strategy

- 2)Establishing an environment where appropriate risk-taking by executive directors is supported

- 3)Carrying out effective oversight of directors concurrently serving as executive officers from an independent and objective standpoint

Article 12Policies and procedures in nomination of the management

- 1.Senshukai shall establish policies and procedures for the appointment and dismissal of internal directors, external directors, and corporate auditors, and the appointment of directors and corporate auditor candidates to the general meeting of shareholders as set forth in paragraphs 2 to 4.

- 2.Senshukai has the Nomination and Compensation Advisory Committee, chaired by an independent outside director, and composed of a majority of independent directors.

All the directors will be deliberated to see if they meet the following selection criteria determined through deliberation by the committee.

The Board of Directors will determine the content of the proposal for the election of Directors based on the report of the Committee and submit it to the General Meeting of Shareholders.

The proposal for the appointment of corporate auditors will be deliberated by the Board of Directors with due respect for the deliberation regarding the appointment of the Board of Corporate Auditors, and will be submitted to the General Meeting of Shareholders after obtaining the consent of the Board of Corporate Auditors based on the Companies Act.

- (Internal director)

- 1) Considering the reason for existence of a company as social contribution, and having an awareness and willingness to contribute to society through good products and services.

- 2) Having the ability to accurately grasp changes in the business environment and to envision business strategies.

- 3) Having a strong attitude, decisiveness, execution and courage to work through overcoming difficult problems.

- 4) To have the leadership to put together executives and employees and execute their abilities to execute management strategies and overcome challenges.

- 5) Experience and knowledge about our business that can supervise the business execution of other directors, and knowledge about corporate governance.

- 6) Having a high awareness of compliance with laws and social norms.

- 7) Having a personality, humanity,that can earn high trust from customers, shareholders, investors, executives and employees, society and other stakeholders.

- 8) Must have the ability to explain business strategies and business conditions to stakeholders such as customers, shareholders, investors, executives and employees, and society.

- 1) Considering the reason for existence of a company as social contribution, and having an awareness and willingness to contribute to society through good products and services.

- 2) Have experience and knowledge about our business that can supervise the business execution of other directors, and have knowledge about corporate governance.

- 3) Having a high awareness of compliance to comply with laws and social norms.

- 4) Having a personality, humanity,that can earn high trust from customers, shareholders, investors, executives and employees, society and other stakeholders.

- 5) Having the ability to reflect the opinions of minority shareholders on the Board of Directors and the ability to supervise in the event of a conflict of interest, independent of management and controlling shareholders.

- 6) Be able to secure sufficient time to carry out our duties.

- 7) Human resources that match the composition of the Board of Directors that the Nomination and Compensation Advisory Committee considers desirable.

(Outside Director)

- 3. If the Board of Directors determines that the Directors do not meet the criteria set forth in the preceding paragraph,or if the Audit & Supervisory Board Members do not qualify as Audit & Supervisory Board Members of the Company, the Board of Directors shall be based on the report of the Nomination and Compensation Advisory Committee,As for Audit & Supervisory Board Members, the proposal for dismissal will be submitted to the General Meeting of Shareholders after fully respecting the deliberations of the Audit & Supervisory Board.

- 4. The Board of Directors will propose to the General Meeting of Shareholders the election or dismissal of individual Directors and Audit & Supervisory Board Members in accordance with the specific circumstances, in accordance with paragraph 2 and the preceding paragraph.

Article 13Role of Auditors and Audit & Supervisory Board

- 1.Auditors and the audit & supervisory board exercise their rights from an independent and objective standpoint in auditing the performance of directors' duties, appointing and dismissing accounting auditors, and determining auditor remuneration.

- 2.Auditors and the audit & supervisory board positively and actively exercise their rights and express their views at board of directors meetings.

- 3.Auditors attend board of directors meetings and other important meetings, audit the performance of directors' duties through operational and accounting audits, and as necessary exchange views with outside directors.

Article 14Roles and independence standards of outside directors

- 1.Senshukai expects the following roles and responsibilities of independent outside directors.

- 1)Providing advice for the enhancement of corporate value

- 2)Monitoring the management function of inner directors

- 3)Monitoring conflicts of interest between the company and its directors, executive officers, and controlling shareholders

- 4)Representing the views of minority shareholders in the boardroom from an independent standpoint

- 2.Senshukai appoints at least three independent outside directors to represent independent and objective views in the boardroom.

By appointing three or more independent outside directors, it is expected that more useful opinions will be formed and the reflection of those opinions will be further promoted. - 3.Senshukai adopts the independence standards prescribed by the Tokyo Stock Exchange as well as the following independence standards for independent outside directors and independent outside auditors.

<Independence standards>

Senshukai deems outside directors and outside auditors (including candidates) independent when the respective individual does not identify with (1) to (4) below. The number of other positions served by directors and auditors, including outside directors and outside auditors, is prescribed in (5) below.- (1)Business partner: When payment between Senshukai and the company at which the individual serves as executive, and the annual transaction amount calculated from the average of the past three business years is 2% or more of the consolidated net sales of either company.

- (2)Specialist: When remuneration or payment is received from Senshukai for specialist legal, accounting, or tax services, and the annual amount calculated from the average of the past three business years is 10 million yen or more in the case of a sole proprietor, or 2% or more of net sales of an incorporated firm in the case the individual is employed.

- (3)Donee: Donation destination: Donations from the Company to non-profit organizations that are in charge of business execution are 10 million yen per business year on average for the past three business years or 30% of the total annual cost of the organization. When either of the larger amounts is exceeded.

- (4)Relatives of the above-mentioned (1) to (3) or the business executives of the Company or its subsidiaries : When a relative within the second degree of affiliation is in the position of (1) to (3) above, or an important executive officer of the Company or a subsidiary of the Company, or in the past five years.

- (5)Number of companies concurrently serving as officers: In cases where there is a concurrent appointment as an officer (director, corporate auditor or executive officer) of a listed company, the number of companies shall be within 4 companies in addition to the Company.

Article 15Role of Nomination and Compensation Advisory Committee

- 1.Senshukai will establish a Nomination and Compensation Advisory Committee, which includes outside directors as members, as an advisory body to the Board of Directors.

- 2.The Nomination and Compensation Advisory Committee discusses the following matters and reports to the Board of Directors.

- 1)Performance evaluation of directors of the Company and major business subsidiaries

- 2)Standards for remuneration of the management of Senshukai and its major business subsidiaries

Article 16Remuneration of the management

The remuneration for officers of the Company is determined within the range of 400 million yen per year for directors and 70 million yen per year for corporate auditors, which was resolved at the general meeting of shareholders held on March 29, 2007.

Compensation for internal directors is based on the executive compensation policy decided by the Board of Directors after being consulted and reported by the Nomination and Compensation Advisory Committee, which is chaired by an independent outside director and has a majority of independent officers.

The design is designed to consist of fixed remuneration, performance-linked bonuses, and transfer-restricted shares, which are remuneration linked to medium- to long-term stock prices, and the payment has been decided.

As for the remuneration of outside directors, only fixed remuneration is paid to ensure independence.

The remuneration of Audit & Supervisory Board Members is also decided through discussions with the Audit & Supervisory Board to ensure independence, and only fixed remuneration is paid.

Article 17Active board deliberations

- 1.Senshukai shall formulate an annual schedule for the Board of Directors, and as a general rule, the schedule shall be such that all Directors and Audit & Supervisory Board Members may attend.

- 2.In setting the schedule referred to in the previous paragraph, when the contents of the agenda are determined in advance, sufficient time for deliberations is secured.

- 3.As a rule, materials are distributed in advance to promote active discussion on the day of the meeting.

- 4.For important matters, information is shared with directors and auditors prior to deliberations. Several sessions are arranged in accordance with the degree of importance of proposals.

Article 18Training policy

- 1.Senshukai policy is to conduct training as needed so that directors and auditors may adequately fulfill their respective roles.

- 2.The training referred to in the preceding paragraph aims to provide directors and auditors with knowledge necessary to perform their duties and with knowledge and information suited to the changing times so that directors and auditors may contribute to the growth of Senshukai.

Article 19Policy for promoting constructive dialogue

- 1.Senshukai engages in constructive dialogue with shareholders even outside the general shareholders meeting. Executive and directors (including outside directors) strive to develop a balanced understanding of the positions of shareholders and other stakeholders, and act accordingly.

- 2.Senshukai provides accurate information in a timely, fair manner and engages in constructive dialogue with shareholders and investors in active efforts to build relationships of trust over the long term. The board of directors does this according to the following policy

- 1)Officer responsible for IR: The director overseeing the Corporate Management department, which is responsible for IR, is named officer responsible for IR. The director's responsibilities include individual meetings.

- 2)Department responsible for IR: Corporate Management department, which is responsible for IR, maintains close contact and shares information with relevant internal departments.

- 3)Engagement with investors: Corporate Management department, actively accepts requests for individual meetings and organizes earnings presentations each half-year in which the president and the director responsible for IR directly provide briefings for shareholders, investors, and analysts. Efforts are made to enhance understanding of individual investors in Senshukai through dedicated contents provided on the Senshukai website (https://www.senshukai.co.jp/main/top/ir/invest/index.html).

- 4)Feedback to executive directors and the board of directors: Feedback on IR activities is reported as needed at board of directors meetings in efforts to share information with directors and auditors.

- 5)Control of insider information: When engaging in dialogue with shareholders, investors, and analysts, thorough efforts are made to control insider information in accordance with the Senshukai Group Insider Trading Prohibition Regulations.

Article 20Revision rights

These Guidelines may be revised with approval from the board of directors. The contents of these Guidelines are revised automatically in accordance with revisions made to the corporate governance report.

Status to the Corporate Governance Code

[Replenishment Principle 4-2-1 Management Remuneration]

The remuneration for internal directors of the Company is based on the executive compensation policy decided by the Board of Directors after being consulted and reported by the Nomination and Compensation Advisory Committee, which is chaired by an independent outside director and has a majority of independent officers.

The design is designed to consist of fixed remuneration, and performance-linked bonuses, and transfer-restricted shares, which are remuneration linked to medium- to long-term stock prices, and the payment has been decided.

As for the remuneration of outside directors, only fixed remuneration is paid to ensure independence.

The remuneration of Audit & Supervisory Board Members is also decided through discussions with the Audit & Supervisory Board to ensure independence, and only fixed remuneration is paid.

Principle 1.4Strategically held shares

<Policy for reduction of strategically held shares>

From a quantitative perspective, the amount of strategically-held shares recorded is small in the consolidated balance sheet, and from a qualitative perspective, the relationship with the issuer's business, corporate collaboration and business synergies, business strategy, business relationships, etc. are comprehensive. In consideration of this, we plan to reduce the number of strategically held shares that we judge to have no significance.

<Individual verification of suitability>

Each year, the Board of Directors reports on individual strategically-held stocks, and specifically considers the suitability of holdings in consideration of the issuer's business relationships, corporate partnerships and business synergies, business strategies, transaction relationships, and various other circumstances. We will examine the necessity of continuous ownership and sale by scrutinizing, and will promote reduction.

<Voting Rights Exercise Standard>

Senshukai will make individual decisions regarding the exercise of voting rights for strategically held stocks after comprehensively considering the medium- to long-term improvement of the corporate value of the issuing company and the possibility of adversely affecting the Group. With respect to the surplus disposal bill, the dividend payout ratio will be used. For other bills, the judgment criteria will be whether or not it will contribute to the enhancement of the corporate value of the Company.

Principle 1.7Related party transactions

When engaging in transactions with the management and major shareholders, Senshukai requires approval and reporting at board of directors meetings, where the matter is treated as an approved item based on the Board of Directors Regulations.

As a rule, the aforementioned board meetings require the attendance of independent outside directors. Any views presented are recorded in the board meeting minutes.

As a measure to build a system for controlling conflicts of interest, a survey is conducted each year targeting all officers of Senshukai (including major subsidiaries) to verify whether or not related party transactions have taken place.

Principle 2.6Demonstrate the function of corporate pension asset owner

The Company has adopted a corporate defined contribution pension plan for the stable asset formation of employees. We have established a system that allows you to browse the system explanations and asset management manuals, etc., on the intranet at any time.

Principle 3.1Enhancement of information disclosure

(i)For corporate philosophy, management strategies, and management plans, refer to the Senshukai website (https://www.senshukai.co.jp/main/top/ir/policy.html).(ii)For basic views and guidelines on corporate governance, refer to I.1 of this report, the Senshukai annual securities report, and the Senshukai website (https://www.senshukai.co.jp/main/top/ir/governance/index.html).

(iii)Policies and procedures in determining remuneration of executive and directors

Regarding the compensation of internal directors, within the limit of the total amount of compensation for directors decided by the general meeting of shareholders, considering the business performance, management content, economic conditions, etc. of the Company, an independent outside director is chaired and a majority is composed of independent officers. Will be deliberated by the Nomination and Remuneration Advisory Committee. The board of directors will make a decision based on the results.

(iv)Policy and Procedures for Appointment and Dismissal of Management and Nomination of Candidates for Directors and Corporate Auditors

In consideration of the balance of knowledge, experience and abilities of the entire Board of Directors and Audit & Supervisory Board, diversity and appropriate size, the Company elects and dismisses internal directors, outside directors, and Audit & Supervisory Board Members, and The nomination policy and procedures are as follows

1. Appointment and nomination

The Nomination and Compensation Advisory Committee, which is chaired by an independent outside director and consists of a majority of independent officers, will discuss whether the following selection criteria are met. The Board of Directors will determine the content of the proposal for the election of Directors based on the report of the Committee and submit it to the General Meeting of Shareholders.

The proposal for the appointment of corporate auditors will be deliberated by the Board of Directors with due respect for the deliberation regarding the appointment of the Board of Corporate Auditors, and will be submitted to the General Meeting of Shareholders after obtaining the consent of the Board of Corporate Auditors based on the Companies Act.

(internal director)

(1) Being conscious of and willing to contribute to society through good products and services by regarding the reason for the existence of a company as contributing to society.

(2) Having the ability to accurately grasp changes in the business environment and to envision business strategies.

(3) Having a strong attitude, decisiveness, execution ability, and courage to work through overcoming difficult problems.

(4) To have the leadership to put together executives and employees and execute their abilities to execute management strategies and overcome challenges.

(5)Have experience and knowledge about our business that can supervise the business execution of other directors, and have an insight about corporate governance.

(6)Having a high awareness of compliance with laws and social norms

(7) Having a personality, humanity, and popularity that can earn the high trust of customers, shareholders, investors, executives and employees, society, and other stakeholders.

(8)Must have the ability to explain business strategies and business conditions to stakeholders such as customers, shareholders, investors, executives and employees, and society.

(Outside Director)

(1) Being conscious of and willing to contribute to society through good products and services by regarding the reason for the existence of a company as contributing to society.

(2) Have experience and knowledge about our business that can supervise the business execution of other directors, and have knowledge about corporate governance.

(3) Having a high awareness of compliance to comply with laws and social norms

(4) To have the personality, humanity, and popularity to earn the high trust of customers, shareholders, investors, executives, employees, and other stakeholders.

(5) Having the ability to reflect the opinions of minority shareholders on the Board of Directors and the ability to supervise in the event of a conflict of interest, independent of management and controlling shareholders.

(6) Be able to secure sufficient time to carry out our duties.

(7) Human resources that match the composition of the Board of Directors that the Nomination and Compensation Advisory Committee considers desirable.

2. Dismissal

If the Board of Directors determines that the Directors do not meet the criteria set forth in the preceding paragraph, or if the Audit & Supervisory Board Members do not qualify as Audit & Supervisory Board Members of the Company, the Board of Directors shall be based on the report of the Nomination and Compensation Advisory Committee, As for Audit & Supervisory Board Members, the proposal for dismissal will be submitted to the General Meeting of Shareholders after fully respecting the deliberations of the Audit & Supervisory Board.

(V) Explanation of individual appointment/dismissal and nomination

The Board of Directors proposes the appointment or dismissal of individual Directors and Audit & Supervisory Board Members to the General Meeting of Shareholders in accordance with the specific circumstances based on the policy and procedure in (iv) above.

For the reasons for the appointment of individual directors as of the date of this report, please refer to the draft proposal for the election of directors in the Reference Documents for the General Meeting of Shareholders dated March 11, 2021.

https://www.senshukai.co.jp/main/top/pdf/soukai_21_1.pdf

Similarly, for the reasons for the appointment of individual Audit & Supervisory Board Members, please refer to the description of the proposal for election of Audit & Supervisory Board Members in the Reference Documents for the General Meeting of Shareholders dated March 12 2018,and March 6 2019, and March 9 2020.

https://www.senshukai.co.jp/main/top/pdf/soukai_18_1.pdf

https://www.senshukai.co.jp/main/top/pdf/soukai_19_1.pdf

https://www.senshukai.co.jp/main/top/pdf/soukai_20_1.pdf

Supplementary Principle 4.1.1Overview of the scope of delegation to management

The Board of Directors decides on important business operations, but some of them may be entrusted to the Directors, etc. In that case, the authority regarding deliberation, approval, approval, etc. shall be clearly defined in the regulations of the Board of Directors.

Principle 4.9 Independence standards and qualifications for independent directors

In addition to the independence standards established by the Tokyo Stock Exchange, the following standards regarding independence, etc. shall be applied to persons who will become independent outside directors and independent outside corporate auditors.

<Independence standards>

Senshukai deems outside directors and outside auditors (including candidates) independent when the respective individual does not identify with i) to iv) below. The number of other positions served by directors and auditors, including outside directors and outside auditors, is prescribed in v) below.

- (i)Business partner

The amount of transactions between the company in which you are a business executor and our company is 2% or more of the consolidated sales of one of the companies on average for the past three business years. - (ii)Specialist

When remuneration or payment is received from Senshukai for specialist legal, accounting, or tax services, and the annual amount calculated from the average of the past three business years is 10 million yen or more in the case of a sole proprietor, or 2% or more of net sales of an incorporated firm in the case the individual is employed - (iii)Donation destination

When donations are received from Senshukai to the non-profit organization (NPO) at which the individual serves as executive, and the annual amount calculated from the average of the past three business years exceeds either 10 million yen or 30% of the annual expenditure of the NPO, whichever is greater - (iv)Close relative of i) to iii) above or of an executive of Senshukai or its subsidiary

When the individual is a family member up to the second degree of i) to iii) above or of a major executive, either currently or at any time within the past five years, of Senshukai or its subsidiary - (v)Number of other positions served by the management

The number of positions served as the management (director, auditor, or executive officer) of listed companies other than Senshukai is limited to four.

Supplementary Principle 4.11.1View on skills of the board as a whole and procedures for nominating directors

Refer to Principle 3.1 iv).

Supplementary Principle 4.11.2Directors and auditors serving other positions

Outside directors and outside auditors, and other directors and auditors, devote sufficient time and effort required to appropriately fulfill their respective roles and responsibilities. Where directors and auditors also serve as the management of other listed companies, such positions are limited to a reasonable number pursuant to independence standards prescribed by Senshukai (see Principle 4.9 v)) and disclosed in the business and securities reports each year.

Supplementary Principle 4.11.3.Outline of analysis and evaluation results of effectiveness of the board as a whole

Since fiscal 2016, Senshukai have conducted a questionnaire to directors and corporate auditors regarding the effectiveness of the board of directors, and have endeavored to improve the function of the board of directors by analyzing and evaluating the results.

From fiscal 2020, effectiveness evaluations have been conducted on 1. Board of Directors, 2. Nomination and Compensation Advisory Board, and 3. Individual Directors.

1. Regarding the Board of Directors , the “composition” such as the number of people, the ratio outside the company, and skills was highly evaluated compared to the previous year. As an issue, it was said that it was necessary to secure more human resources that were in line with our future medium- to long-term corporate strategy. In FY2021, the Nomination and Compensation Advisory Board will play a central role in defining and selecting human resources that match the strategy.

Regarding the "preparation and operation" of the Board of Directors, since there were many important deliberation items, it often took days and time for deliberation, so the preparation method should be improved to enable more efficient operation. There were issues such as. In FY2021, we will review the matters to be discussed by the Board of Directors and consider improvement measures such as the staff system.

Regarding the "effectiveness of discussions" at the Board of Directors, we received a higher evaluation than the previous year for active discussions with internal and external officers. It was pointed out that it is desirable to secure more opportunities for deliberation on medium- to long-term strategic issues, including efforts for SDGs and ESG, as well as deliberation on matters that should be dealt with from time to time. had. In FY2021, we will proceed with the selection of the above items to further increase the opportunities for deliberation on medium- to long-term strategic issues.

2. Regarding the effectiveness of the Nomination and Compensation Advisory Board, the chairman is an independent outside director, and the majority of the members are independent officers. It was highly evaluated, such as securing sufficient time and days for deliberation compared to other companies, and setting a sufficient agenda based on trends in corporate governance.

Regarding the successor plan, we implemented measures such as nominating future management candidates and conducting interviews at the Compensation Advisory Board, but it was pointed out that further strengthening of efforts is necessary in the future as an issue.

In FY2021, we will position "human resources development" as one of the most important themes, and will strengthen the examination of measures to secure successor human resources centered on the Nomination and Compensation Advisory Board.

Regarding item 3, the Nomination and Compensation Advisory Committee provided an opportunity to consider the evaluation of candidates for reappointment to determine the reappointment of directors, and as a result of the examination, all candidates carried out activities that contributed to the effectiveness of the board of directors. In addition to pointing out issues, the chairman or committee members gave feedback on the evaluation to the person himself / herself.

Supplementary Principle 4.14.2Training policy for directors and auditors

Senshukai policy is to conduct training as needed so that directors and auditors may adequately fulfill their respective roles.

The aforementioned training aims to provide directors and auditors with knowledge necessary to perform their duties and with knowledge and information suited to the changing times so that directors and auditors may contribute to the growth of Senshukai.

Principle 5.1Policy for promoting constructive dialogue with shareholders

Senshukai provides accurate information in a timely, fair manner and engages in constructive dialogue with shareholders and investors in active efforts to build relationships of trust over the long term. The board of directors does this according to the following policy.

- (i)Officer responsible for IR

The director overseeing the Corporate Management department, which is responsible for IR, is named officer responsible for IR. The director's responsibilities include individual meetings. - (ii)Department responsible for IR

Corporate Management department, which is responsible for IR, maintains close contact and shares information with relevant internal departments. - (iii)Engagement with investors

The Corporate Management department, actively accepts requests for individual meetings and organizes earnings presentations each half-year in which the president and the director responsible for IR directly provide briefings for shareholders, investors, and analysts. Efforts are made to enhance understanding of individual investors in Senshukai through dedicated contents provided on the Senshukai website (https://www.senshukai.co.jp/main/top/ir/invest/index.html). - (iv)Feedback to directors and the board of directors

Feedback on IR activities is reported as needed at board of directors meetings in efforts to share information with directors and auditors. - (v)Control of insider information

When engaging in dialogue with shareholders, investors, and analysts, thorough efforts are made to control insider information in accordance with the Senshukai Group Insider Trading Prohibition Regulations.

Governance System

Compensation for Senshukai's directors and auditors in Fiscal Year 2020 was as follows.

| Category | Number of members | Compensation paid |

|---|---|---|

| Directors | 9 | 91 million yen total (24 million yen to 4 outside directors) |

| Auditors | 5 | 40 million yen total (11 million yen to 3 outside auditors) |

※The above includes two director(includes one outside director) and one outside corporate auditors who resigned as of July 31, 2020.

※ Directors' remuneration, etc. does not include employee salaries for directors who also serve as employees.

※The maximum amount of remuneration for directors was resolved at the 62nd Ordinary General Meeting of Shareholders held on March 29, 2007 to be less than 400 million yen per year (however, salaries for employees are not included).

※The maximum amount of remuneration for Audit & Supervisory Board Members was resolved at the 62nd Ordinary General Meeting of Shareholders held on March 29, 2007 to be no more than 70 million yen per year.

Internal Control System

1. Systems for ensuring compliance by directors and employees with legal regulations and the Company's Articles of Incorporation in the execution of operations

- (1)Regarding compliance, the Group has prepared its Senshukai Group Compliance Policy and established its Corporate Ethics Hotline as an internal reporting system designed to expeditiously deal with potential risks regarding noncompliance with public laws and regulations as well as internal rules and other potential noncompliance risks.

- (2)In the event of compliance problems related to corporate officers (directors, auditors) or employees, based on internal rules, problems reported via internal or external versions of the Corporate Ethics Hotline are reported to and deliberated by the Board of Corporate Auditors, in the case of problems related to officers, or by the Ethics and Compliance Committee, in the case of problems related to employees.

- (3)Appropriate measures are being taken to offer corporate officers and employees compliance education programs, including e-learning and Internet-based programs.

- (4)Regarding the Company's internal controls, based on internal rules, we have established an Audit Office reporting directly to the president. In this way, a system has been created for conducting internal audits aimed at grasping and enhancing business operations and reporting on such matters to the president.

- (5)Regarding intellectual property, Senshukai's Risk manegement Department prior checks of related issues. Regarding responsibility with respect to manufactured goods, the Company's Quality Management Committee undertakes deliberations and makes decisions on merchandise items subject to marketing regulations.

2. Systems for safekeeping and management of information related to the execution of the duties of the directors

- (1)Information relating to the execution of the duties of the directors is preserved and managed in strict accordance with Rules on the Handling of Documents and Rules on Data Administration.

- (2)Regarding the Company's important confidential items, separate Rules on the Handling of Confidential Documents have been established, and the important confidential items are managed in strict accordance with those rules.

- (3)The revision of important internal rules is undertaken only after the receipt of approval from the Board of Directors.

- (4)Information relating to the execution of the duties of the directors may be viewed by the directors and auditors through the intranet (internal network) at any time.

3. Regulations and other systems related to the management of dangers of losses

- (1)We classify the risks involved in the management of the company, establish a department or committee for each risk to clarify the management system, and establish a system to quickly respond when problems occur. In addition, the management status of each risk is compiled by the "Risk Management Control Committee Secretariat" and immediately reported to the "Risk Management Control Committee" composed of members of the Management meeting every month or in an emergency.

- (2)Regarding specific crisis management response measures, when required, crisis management manuals are prepared for each risk category to establish a system that provides for concrete response measures.

- (3)As a system for the unforeseen situation of directors, we will establish a system that can smoothly perform business operations.

4. Systems for ensuring that the duties of the directors are performed efficiently

- (1)We have established “Company Regulations” and “Regulations for Approving Matters”, and clarify the roles of the Board of Directors, the Management meeting, the Audit & Supervisory Board, etc., the positions of employees, the division of duties, the authority of duties, the roles, the Approval authority, etc. In order to ensure the efficiency of business, the system shall be established.

- (2)Introduce an outside director (part-time) system to increase the transparency of the board of directors and strengthen the supervisory function.

- (3)Introduce a “headquarters system” and clarify the authority and responsibility of management decision-making functions and business execution functions to improve management efficiency.

- (4)Separately from the Board of Directors, a “Management meeting” consisting of full-time directors and corporate auditors will be established in principle, and a system will be established to make decisions on important business operations delegated by the Board of Directors and to make swift decision-making.

5. Systems for ensuring the appropriate execution of business by the Company’s corporate group, comprising the parent company and subsidiaries

- (1)Senshukai and Group companies formulate and implement "Affiliated Company Management Regulations" in order to improve the corporate value of the entire group and fulfill their social responsibilities, and important matters of subsidiaries with 50% or more ownership Will be approved by the parent company.

- (2) By having each supervising department supervise the subsidiary, close coordination of command, order, and communication between the parent and subsidiary, and provide appropriate guidance and advice and evaluation while optimizing the work of the group as a whole.

- (3) Among business subsidiaries, companies without a board of directors make various reports at monthly regular meetings. Business subsidiaries share sales and profit reports at monthly meetings held monthly and report at least once a year directly from the president of the business subsidiary to the president of the Company.

- (4) Regular meetings are held between the audit corporation and the directors of the parent company to exchange opinions on the status of the entire group.

- (5) Formulate rules for insider trading common to group companies and rules for whistleblowing, and conduct common compliance education for officers and employees of group companies.

- (6) Develop a medium- to long-term management plan for the group and operate it efficiently.

- (7) The personnel affairs of the subsidiary shall be appointed and dismissed by the "Management meeting" and the representative director of the subsidiary shall be appointed and dismissed by the Board of Directors.

- (8) Group companies maintain and manage regulations according to the degree of risk.

- (9) Directors, corporate auditors, and employees of the Company concurrently serve as directors and corporate auditors of group companies as necessary, and cooperate with departments in charge of the business of group companies based on the "Affiliate Company Management Regulations" Guidance and support to ensure legal compliance and business adequacy in Japan.

6. Matters relating to the employee when the Audit & Supervisory Board Member requests that there be an employee who should assist the duties, Matters concerning the independence of the employee from the director and matters concerning ensuring the effectiveness of the instructions of the corporate auditors to the employee

- (1)In response to the request of corporate auditors, one dedicated staff member has been appointed to assist them.

- (2)With respect to the appointment, transfer, personnel evaluation, and disciplinary action of the staff of the Audit & Supervisory Board Members, the opinions of the Audit & Supervisory Board will be respected to the maximum extent.

- (3)The command and order authority for employees who should assist the duties of the corporate auditors shall belong to the corporate auditors.

7. Systems for directors and employees to make reports to the corporate auditors, systems for other reports to be made to the corporate auditors, and systems to ensure the effective conduct of auditing activities by the corporate auditors

- (1)Standing corporate auditors attend important internal meetings as they deem necessary, and receive reports on important information relating to corporate management.

- (2)Standing Audit & Supervisory Board Members attend the "Risk Management Oversight Committee" and discover from each risk management committee or jurisdiction the important matters in the "Corporate Ethics Helpline" and other facts that may cause significant damage to the company. And, immediately report to the Audit & Supervisory Board.

- (3)Regarding materials that Audit & Supervisory Board Members need to view, they will be available for viewing at any time upon request.

- (4)The corporate auditors are provided with reports on the results of internal audits conducted by the Audit Department.

- (5)Audit & Supervisory Board Members regularly hold exchange meetings with the President and audit corporation.

- (6)By conducting audits on a regular basis, the corporate auditors obtain opportunities to conduct hearings with executive officers and important employees.

- (7)Arrangements are also made for the corporate auditors to obtain the advice of specialists when the corporate auditors deem such advice necessary and make related requests.

- (8)The chairman of the "Ethics and Compliance Committee," who was contacted by the Company and the group companies, reports to the Audit & Supervisory Board if there is a serious misconduct of an employee, or if there is a suspicion thereof.

8. System to ensure that those making the reports in the previous section are not treated unfavorably for making such reports

The necessary measures shall be established to ensure that those making the reports in the previous section are not treated unfavorably for having made such reports.

9. Matters related to the policies related to processing debts or costs arising from carrying out other duties or procedures for prepayment or repayment of costs arising from carrying out the duties of auditors

- (1)Costs deemed necessary for carrying out the duties of the auditor shall be budgeted, and when a claim for prepayment, etc., is received, said claim shall, save in the event that it is not valid, be dealt with promptly.

- (2)If deemed necessary for the Company, the Company may approve extra-budget costs.

10. Systems for securing reliability of financial reports

- (1)The Company evaluates and externally reports the reliability of its internal controls over financial reporting in accordance with the Financial Instruments and Exchange Act and related legal regulations.

- (2)In evaluating the effectiveness of its internal controls over financial reporting, the Company sets forth and abides to standard procedures generally accepted as fair and appropriate.

- (3)To ensure the effectiveness of its internal controls over financial reporting, the Company periodically performs internal audits of the entire organization to identify and correct defects and significant flaws in an effort toward continuous improvement.

- (4)In order to support the establishment and operation of effective internal controls required by the president, the evaluation of internal controls related to financial reporting, and the external reporting, the Audit Office is based on the "Regulations and Maintenance of Internal Controls Related to Financial Reporting". Conduct internal audits and report the audit results to the president.

11. Systems against antisocial forces

The Company sets forth the Senshukai Group Compliance Policy and the Senshukai Guidelines for Preventing Damage From Antisocial Forces under which it thoroughly communicates to directors and employees that we deal firmly and shall have absolutely no connection with antisocial forces that threaten order and safety in society.